In an era where travel has become more accessible yet increasingly expensive, savvy travelers are turning to innovative financial strategies to stretch their budgets further. Among these strategies, leveraging cashback and points has emerged as a particularly effective method for reducing travel costs without compromising on quality. This article delves into the mechanics of cashback and rewards programs, offering an analytical perspective on how these tools can be optimized for travel savings. By examining the various types of programs available, their potential benefits, and the strategies for maximizing their value, readers will gain a comprehensive understanding of how to effectively integrate cashback and points into their travel planning. Whether you’re a frequent flyer or an occasional vacationer, understanding these financial instruments can significantly enhance your travel experience, offering both monetary savings and enhanced travel opportunities.

Maximizing Cashback Opportunities for Travel Savings

Unlocking the full potential of cashback offers can significantly reduce your travel expenses. Credit cards with travel rewards are a great place to start, as they often provide cashback on travel-related purchases such as flights, hotels, and car rentals. Look for cards that offer high cashback percentages and bonus points for travel spending. Additionally, many credit cards provide perks like free travel insurance or airport lounge access, adding even more value to your travel experience.

- Stack cashback offers: Combine credit card cashback with online shopping portals or cashback apps to maximize savings.

- Take advantage of promotions: Keep an eye out for special promotions from airlines and hotels that offer increased cashback rates or bonus points.

- Optimize point redemption: Use points strategically for flights or hotel stays where they offer the best value, and combine them with cashback to cover other travel expenses.

For those who prefer flexibility, consider using general cashback credit cards. These allow you to earn cashback on all purchases, which can then be applied to any travel-related expenses. By carefully selecting and managing your cashback and points, you can effectively reduce the overall cost of your trips, allowing you to travel more frequently or indulge in more luxurious experiences without breaking the bank.

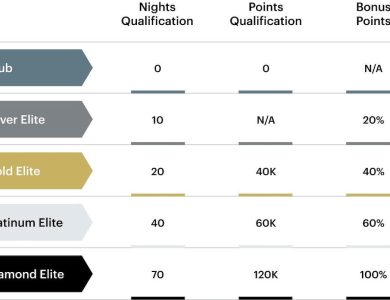

Strategic Use of Credit Card Points for Travel Benefits

Maximizing your credit card points requires strategic planning and understanding the benefits offered by different cards. Start by analyzing the rewards programs and align them with your travel goals. Sign-up bonuses are a great way to kickstart your points collection; these often require meeting a minimum spending limit within a few months. Airline and hotel partnerships can amplify the value of your points, allowing for direct transfers or exclusive deals.

Consider the following strategies to enhance your travel savings:

- Utilize Category Bonuses: Many cards offer extra points for specific categories such as dining or travel. Leverage these to accelerate your points accumulation.

- Off-Peak Travel: Redeem points during off-peak seasons when fewer points are needed for bookings, maximizing your value.

- Combine Points with Cashback: Use cashback to cover travel expenses not covered by points, like meals or excursions.

- Monitor Expiration Dates: Keep track of when your points expire to avoid losing them, and use them strategically before they do.

By understanding and leveraging these elements, you can effectively reduce travel costs and enjoy more adventures without straining your budget.

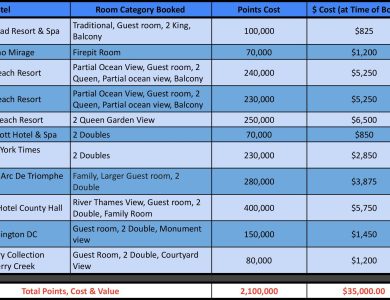

Analyzing Travel Reward Programs for Optimal Returns

When diving into the world of travel reward programs, it’s crucial to dissect each program’s value proposition to ensure you’re getting the most bang for your buck. Cashback and points-based programs each offer unique advantages, but the optimal returns depend on how you leverage them. Cashback programs are straightforward, providing a percentage of your spending back to you. This can be particularly beneficial for travelers who prefer immediate, tangible savings. On the other hand, points-based systems often allow for more flexibility and potentially greater value when redeemed strategically for flights, hotel stays, or even upgrades.

To maximize your rewards, consider these strategies:

- Understand Conversion Rates: Not all points are created equal. Research how much each point is worth in real-world terms, and compare this to cashback options to find the best fit for your spending habits.

- Take Advantage of Sign-Up Bonuses: Many programs offer substantial bonuses for new members. These can be a quick way to accumulate points or cashback, but ensure you meet any spending requirements to qualify.

- Use Program-Specific Credit Cards: These cards often offer higher rewards rates on travel-related purchases and can include additional perks such as airport lounge access or travel insurance.

- Stay Informed: Programs frequently update their terms, including point values and redemption options. Keeping up-to-date ensures you’re always getting the best return on your spending.

By carefully evaluating and utilizing these programs, travelers can significantly reduce their travel expenses while enjoying enhanced travel experiences.

Effective Planning for Combining Cashback and Points

Maximizing your travel savings requires a strategic approach to leveraging both cashback and points. Begin by identifying your travel goals, such as destinations and timelines, which will guide you in selecting the most rewarding programs. Diversify your credit card portfolio to include cards that offer high cashback on travel-related purchases and those that accumulate points quickly. This combination allows you to earn benefits across different categories, from airfare to accommodation.

- Evaluate Cashback Offers: Prioritize credit cards that provide a higher percentage of cashback on travel expenses. Look for seasonal promotions or limited-time offers that might boost your cashback earnings.

- Optimize Points Redemption: Research and understand the point conversion rates for flights, hotels, and car rentals. Consider transferring points to partner airlines or hotels for better redemption value.

- Balance Your Spending: Allocate your expenses strategically between cards to maximize both cashback and points. For instance, use a card with travel bonuses for booking flights and another for everyday purchases to earn cashback.

By carefully planning your spending and redemption strategies, you can enjoy substantial savings on your travel adventures. Regularly review and adjust your strategy based on changes in offers and personal travel preferences to ensure optimal benefits.